Which of the Following Best Describes Fixed Period Settlement Option

Which of the following best describes fixed-period settlement option. A Only the principal amount is likely to be given out in just a period that is specified of.

Classifying Liabilities As Current Or Non Current Kpmg Global

Which for the following best defines settlement option that is fixed-period.

:max_bytes(150000):strip_icc()/dotdash_Final_Netting_Oct_2020-01-b5e667983a3b4fbda61e968ac11d96bc.jpg)

. Five ten or twenty years. Your client plans to retire at age 50. The shorter the period of time the larger each installment c.

Which type should he buy. Both the principal and interest will be liquidated over a selected period of time The primary beneficiary of her husbands life policy found that no settlement option was stated in. The longer the period of time the smaller each installment.

Equal payments are made over a specific time frame selected by the annuitant eg. The four most common alternative settlement approaches are. Of years is selected and equal installments are paid to the recipient.

Both the principal and interest will be liquidated over a selected period of time. C Income is guaranteed for the full life regarding the beneficiary. Answer choices Only the principal amount will be paid out within a specified period of time.

However if the home is sold before its purchase price has been paid in full the seller is able to recoup the cost of the homes construction. The death benefit must be paid out in a lump sum within a certain time period. This settlement option is good for beneficiaries who need larger payments over a shorter amount of time.

Which type of credit involves a set limit based on what a consumer pays up front. What Is True About Fixed Period And Fixed Amount Settlement Options The four most common alternative settlement approaches are. Under the fixed period option also called period certain a specified period of years is selected and equal installments are.

What proved to be a major hardship for settlement in the new england colonies. All of the following statements are true regarding installments for a fixed period annuity settlement option EXCEPT. Which of the following best describes what the annuity period is.

Both the principal and interest will be liquidated over a selected period of time. What is a fixed period annuity settlement option. Under the fixed period option also called period certain a specified period of years is selected and equal installments are paid to the recipient.

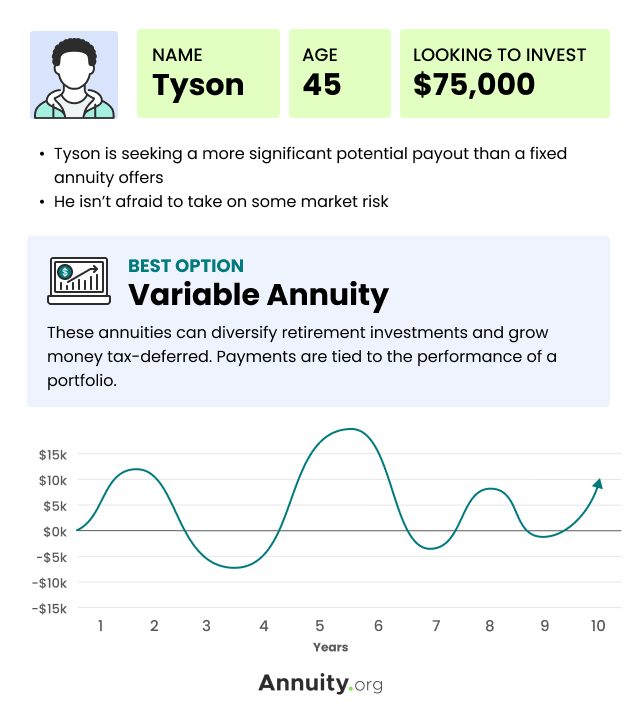

If a settlement option is not chosen by the beneficiary or policy owner which option will be used. A Only the main amount is going to be given out within a period that is specified of. He would like to purchase an annuity that would provide income from the time he retires to the age when social security and other pension funds become available.

Under the fixed period option also called period certain a specified period. Fixed payment and fixed period. The surviving beneficiary will continue receiving 23 of the benefit paid when both beneficiaries were alive An insured has chosen a 23 survivor as the settlement option.

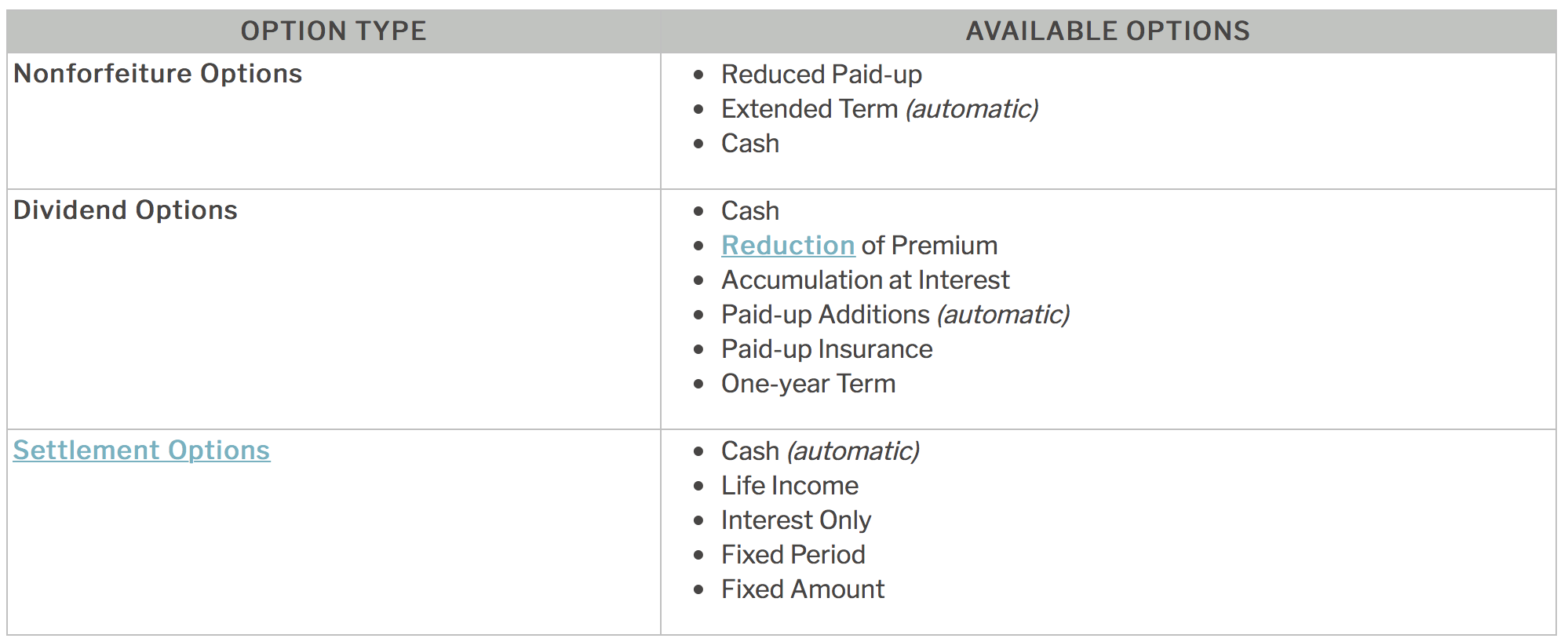

The interest option under which the insurer holds the proceeds and pays interest to the beneficiary until such time as the beneficiary withdraws the principal. The fixed period option under which the future value of the proceeds is calculated and paid in. Under the fixed period option also called period certain a specified period of years is selected and equal installments are paid to the recipient.

There are two subtypes which of all the following best describes the fixed-period settlement option. Both the principal and interest will be liquidated over a selected period of time. Which of the following best describes fixed-period settlement option.

Which of the following best describes fixed-period settlement option. Which of the following best describes fixed period settlement option. What are the types of settlement options.

Which is most responsible. Under the fixed period option also called period certain a specified period of years is selected and equal installments are paid to the recipient. Fixed payment The beneficiary chooses to receive five equal payments of 20000.

With a fixed period settlement your beneficiary receives payments in equal amounts over a specific period of time. Also Know which of the following best describes fixed period settlement option. B The death advantage must certanly be given out in a lump sum in just a particular period of time.

A new settlement that keeps close ties to its homeland. Which of the following statements about the installments for a fixed period settlement option in life insurance policies is NOT true. Which of the following best describes fixed period settlement options.

The periodic payment amount is determined by the beneficiarys age b. What settlement option should he consider. The interest option under which the insurer holds the proceeds and pays interest to the beneficiary until such time as the beneficiary withdraws the principal the fixed period option under which the future value of the proceeds is.

Which type of cost occurs when an individual pays for a piano lesson instead of going to a movie. If the annuitant dies before the end of the. Which of the following best describes fixed-period settlement option.

Which of this following best defines fixed-period settlement choice. Which of the following best describes fixed period settlement option. Income is guaranteed for the life of the beneficiary.

C Income is guaranteed for the full life associated with beneficiary. Which of the following best describes fixed period settlement options. Which of the following best describes fixed period settlement option Fixed settlement is when a home is sold and the buyer pays the seller the amount of the homes purchase price.

The insurance company will agree to pay 20000 plus interest due to the policyholder over time until the full amount due is paid. An applicant wants to buy a life insurance policy in which he can count on receiving the same benefits as stated in the contract. Which of the following best describes fixed period settlement options.

Which of the following best describes fixed-period settlement option. Both the principal and interest will be liquidated over a selected period of time. B The death advantage needs to be given out in a swelling amount within a time period that is certain.

Both the principal and interest will be liquidated over a selected period of time. Which of the following statements best describes north americas population settlement pattern. Which of the following is the best.

If the beneficiary dies before the time period is over the remaining balance will pass to a secondary beneficiary.

Life Insurance Flashcards Quizlet

Policy Provisions Options And Other Features Flashcards Chegg Com

Variable Annuity What Are Variable Annuities How Do They Work

Annuity Payout Options Immediate Vs Deferred Annuities

Policy Provisions Options And Other Features Flashcards Chegg Com

Buy Best Term Insurance Plans In India 2022

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

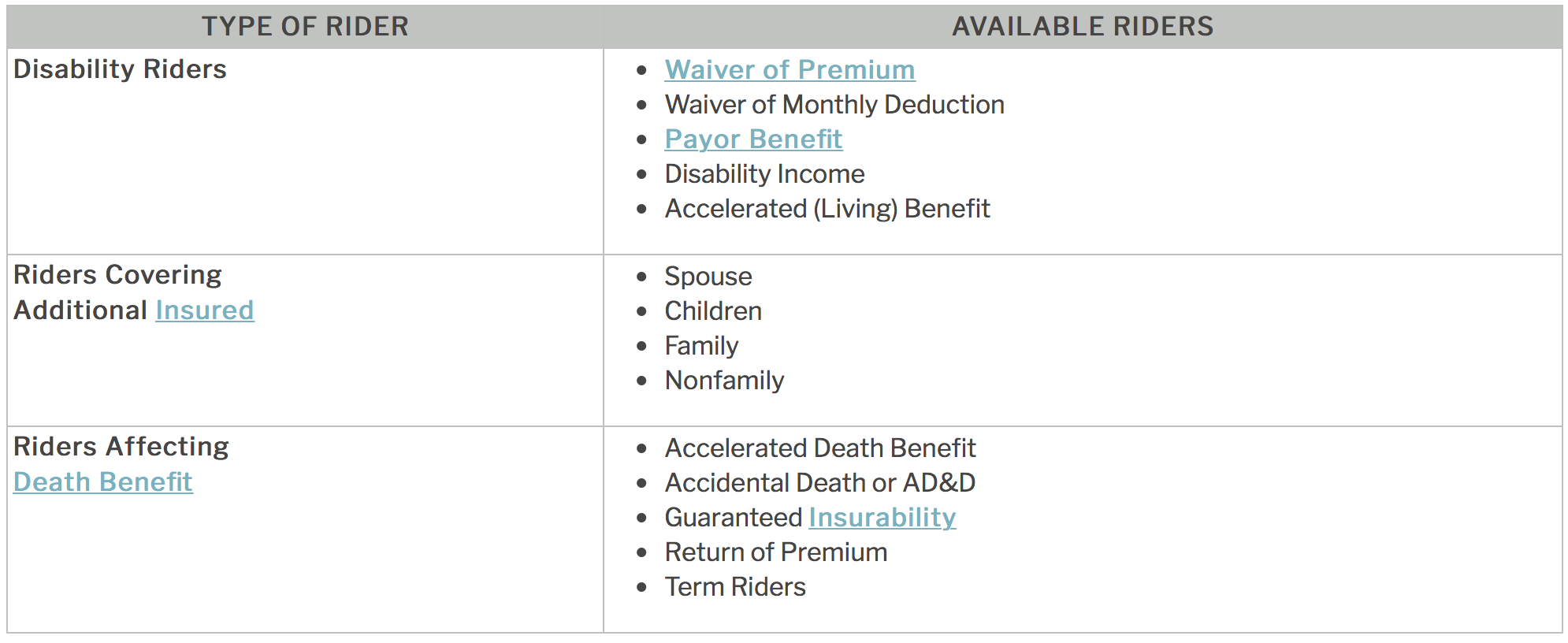

Life Insurance Policy Riders Provisions Options And Exclusions Quiz Flashcards Quizlet

/dotdash_final_An_Introduction_to_Options_on_SP_500_Futures_Jan_2021-01-28d0c2c4c569466384e3ae6123d56d27.jpg)

An Introduction To Options On S P 500 Futures

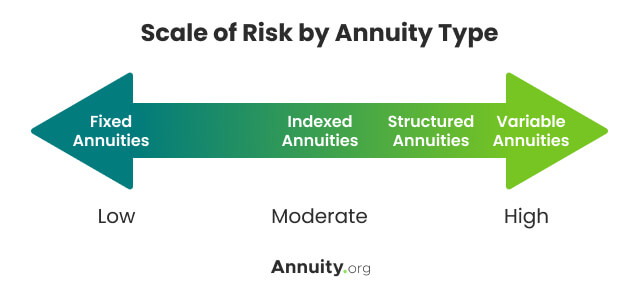

Types Of Annuities Understanding The Different Categories

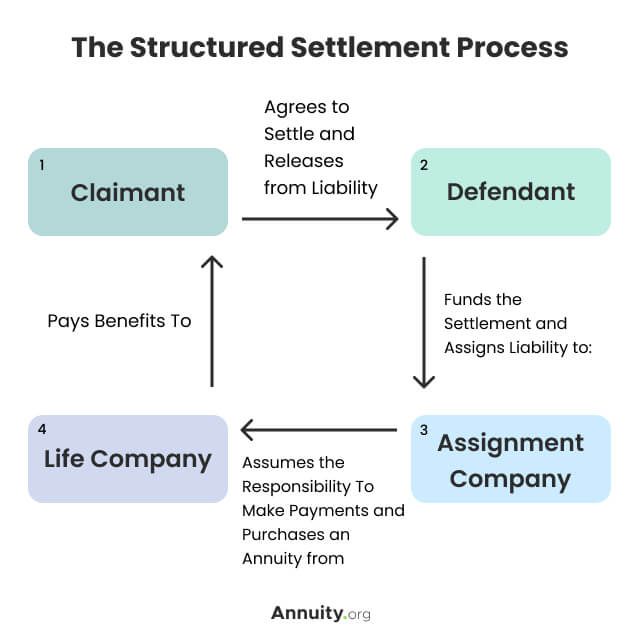

What Is A Structured Settlement And How Do They Work

Life Insurance Flashcards Quizlet

Policy Provisions Options And Other Features Flashcards Chegg Com

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Comments

Post a Comment